An FSA (Flexible Spending Account) and an HSA (Health Savings Account) are tax-advantaged accounts for medical expenses but differ in key aspects. FSAs, employer-sponsored, allow employees to use pre-tax dollars for medical expenses such as prescriptions and copays, but typically feature a "use-it-or-lose-it" policy where funds must be used within the plan year. HSAs are available to those with a high-deductible health plan and offer more flexibility, allowing funds to roll over annually.

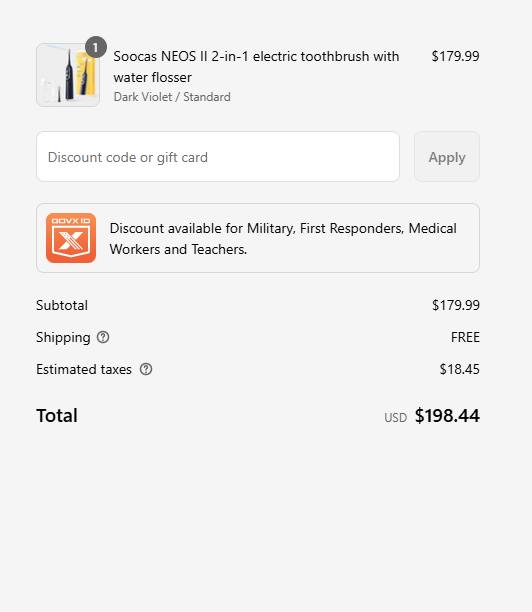

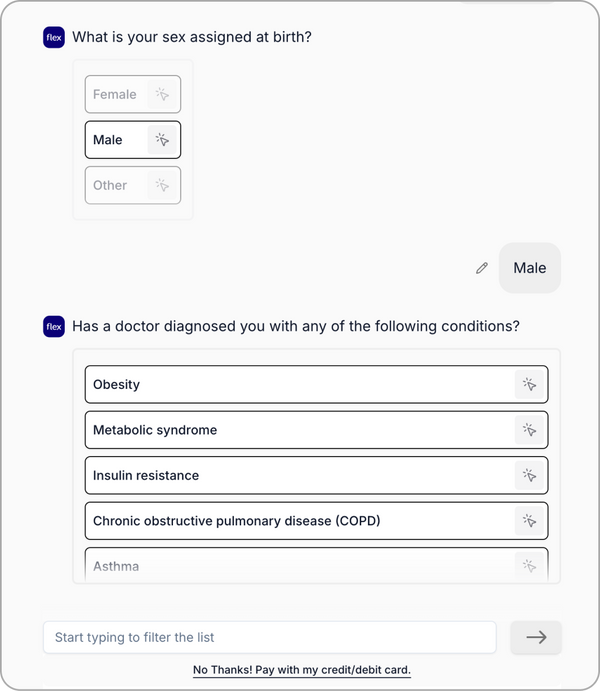

The IRS oversees HSA and FSA eligibility and dictates that a customer must have a medical condition or disease that they are seeking to treat or manage with Soocas. Customers must have documentation that confirms their eligibility, also called a Letter of Medical Necessity. Not to worry, Soocas has partnered with Flex to make this a quick and easy process for customers.

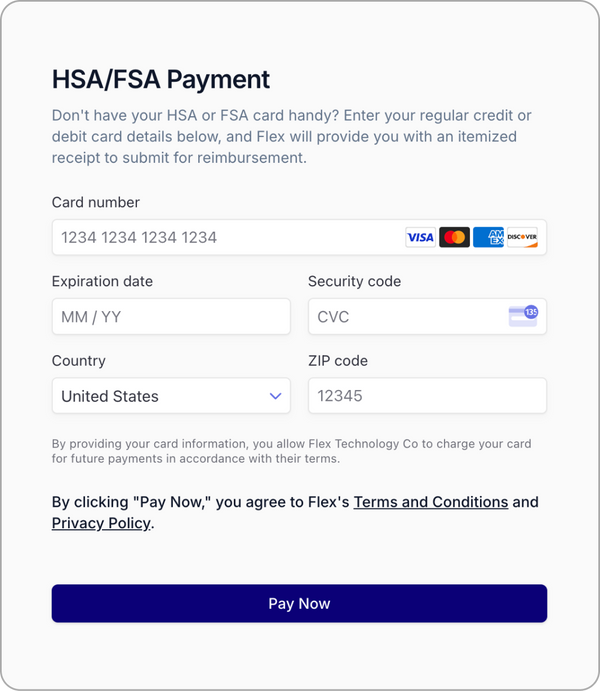

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order.

Like any credit or debit card, HSA/FSAs can be declined if any of the data from the card is incorrect (number, expiration date, zip code etc). Flex will alert you in checkout if any of these fields is missing or incorrect so you can update them.

The most common reason for rejection of the card is insufficient funds. Reach out to your HSA or FSA provider to verify the amount of money in your account before attempting to complete your purchase again.

No, unfortunately, this isn't a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

The key here is to make sure you are logged out of ShopPay. One of the easiest ways to do this is to go through checkout in an incognito window.

Unfortunately, for purchases made without using Flex in the checkout to receive an itemized receipt, it may be difficult to apply for reimbursement.

For Health Savings Accounts (HSAs), consumers can use an itemized receipt for reimbursement anytime after they have made the purchase, even if it is many years later.

For Flexible Spending Accounts (FSAs), most accounts require that the purchase was made in the calendar year during which the consumer had the FSA, as FSAs typically do not roll over. Some FSAs offer a buffer window, allowing customers additional time to submit receipts for expenses incurred during the previous calendar year.